The State of the IT Staffing Market

“Everything, Everywhere, All at Once”

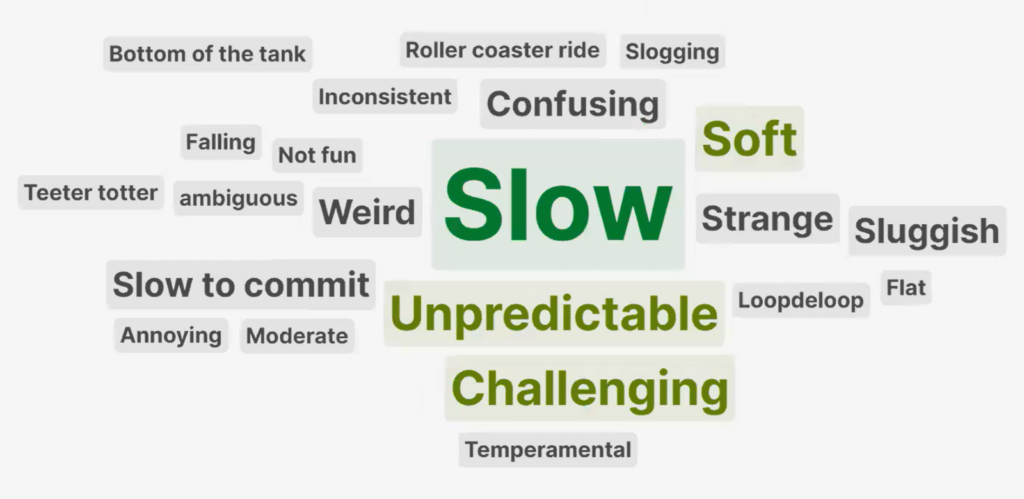

If you ask a group of technology staffing industry leaders how they’d describe the current market, you might hear descriptors such as temperamental, challenging, a rollercoaster, even confusing and weird. We asked, and we heard all those terms.

But the most frequent description likely won’t come as a surprise: slow.

How Would You Describe the Current IT & Engineering Staffing Market?

Mark Roberts, CEO of TechServe Alliance, borrows the title from an appropriately strange movie when he describes our current market as ‘Everything, Everywhere, All at Once.’ “It really is a very strange environment,” Roberts says. “We have a very tight labor supply, without a doubt. But demand is certainly down from what we saw in the first half of last year and in 2021. Some companies are up, some are down.”

Those comments were echoed in the mixed results of a live poll during the recent TechServe webinar. The majority of those attending the webinar reported that their business was down year-over-year:

- 36% of attendees’ business was down by 11% or more,

- 27% were down 0-10%.

However,

- 19% of respondents were up 0-10% year-over-year,

- 9% of respondents were up over 11%

Similarly, the TechServe Alliance Monthly KPI Dashboard shows that the number of new job orders is somewhat higher than in late 2022, but still significantly lower than late 2021. On the other hand, the number of billing consultants, while down somewhat, has held remarkably steady since late 2021.

The signals are indeed scrambled and tough to draw out a single conclusion to describe the state if the technology staffing industry. In Roberts’ view, there is simply no consistent narrative for the current market. Roberts and Jim Janesky, Principal with Forest Hills Advisory LLC, presented to TechServe Alliance members at the recent webinar to help make some sense of these conflicting signals.

Macroeconomic Trends

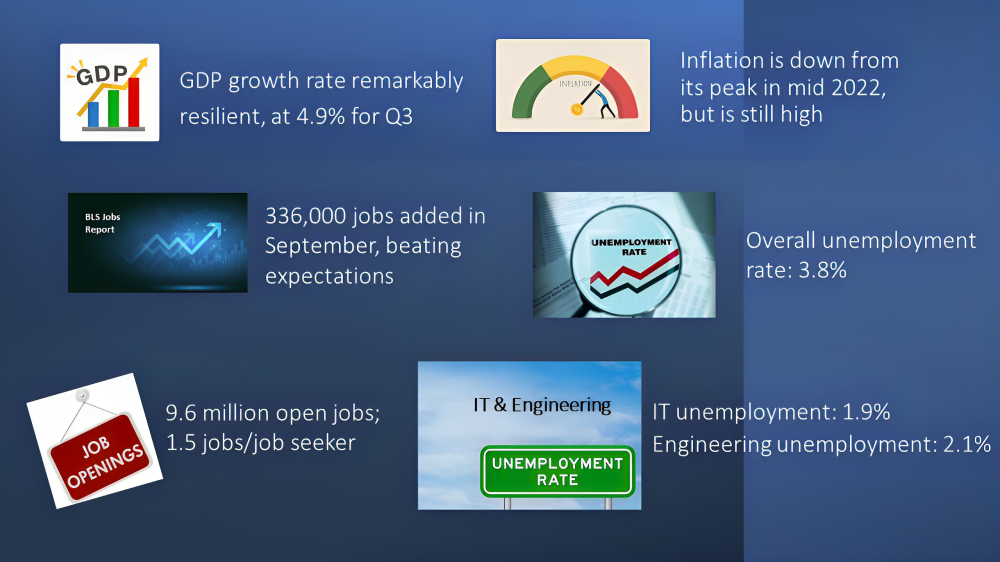

The economic backdrop is a mixed one, too, at least partially accounting for the mixed signals. Some highlights:

According to the TechServe Monthly IT & Engineering Employment Index, since early 2022, there’s been more robust growth in engineering jobs than in the IT sector. “It’s one of the few times I recall where engineering has outpaced IT,” says Roberts.

Looking at the longer-term trend, there was essentially no growth in IT jobs from 2018 up to the onset of the pandemic. This was not due to a shortage in demand; rather, it was a supply challenge. The market sharply declined during COVID, and rebounded with what Roberts terms a ‘hockey stick trajectory’ coming out of the pandemic. The decline since then has been cyclical.

Other Trends Impacting the IT Staffing Industry

In addition to macroeconomic factors, there are three other trends that leaders in IT and engineering staffing should be aware of.

First, the M&A market is still active. Based on the data coming out of the TechServe Alliance M&A Marketplace, there’s continued activity, especially for deals less than $30 million. Multiples have held remarkably steady between 4x at the low end and 7x+ at the high end. Deal structure has been the biggest change, reflecting a higher degree of risk mitigation for buyers. Overall, valuations remain elevated for companies with strong profiles and buyers continue to seek acquisitions in most markets.

Second, the dramtic increase in remote and hybrid work continues to be a key trend that continues post-pandemic. According to TechServe Alliance Operating Practices Report, only around 5% of companies require employees to be in the office five days a week. For about 40% of companies, coming into the offices was entirely optional. The hybrid model was most common, at about 55%.

Notably, Roberts points out, LinkedIn data shows that only 11% of postings offer remote work, while 47% of applications received are for remote positions. This reflects a disconnect in the market.

“There’s a big divide there,” says Roberts. “For clients that are absolutely insistent on someone being on their premises, or even hybrid, it really limits the talent pool. It also presents an opportunity for those that want to be flexible.”

Third, while it is not clear exactly how the continuing AI will affect the staffing industry, there is very little doubt that it will be both a disruptive force and an opportunity. It will be important to keep abreast of these developments.

Although the market is generally soft right now, there have been challenges before. Roberts notes that there is an underlying challenge that won’t be easily solved. “We’ve been through economic declines before. The decline that followed the dot-com bust, Y2K, 9/11, the decline that resulted from the Great Recession, and of course the COVID decline.

“We will come out of [the decline],” Roberts said, “but the ongoing challenge is: how will we deal with this limited talent supply? Those that have a highly effective recruiting engine are going to be best positioned to deal with that challenge.”

Economic and Industry Trends

In the webinar, Jim Janesky once again provided a summary overview of the IT and engineering markets, trends affecting the industry.

In brief:

- The Conference Board is now predicting a mild and short recession through late 2023 and early 2024.

- Weakened consumer spending is the main driver, resulting from high interest rates, inflation, less money in savings, and fewer government handouts.

- IT staffing should outperform most sectors; with an IT unemployment rate less than 2%, candidate supply constraints are still a factor. However, expect and plan for project deferrals and longer sales cycles.

- Industrial production will be anemic through 2023. Expect a rebound when consumer confidence strengthens.

- Engineering staffing will continue to outperform.

One of the biggest unknowns when it comes to recession is the effect of interest rates. “Inflation is declining,” Janesky says, “but it’s still historically high. The Fed never gets it right. Consumer prices stifle consumer spending, which accounts for 65% of GDP. A big percentage of consumer spending is what they spend on gas.”

Janesky also points to the performance of publicly traded companies as an indicator of the state of the industry overall. “The S&P 500 is now outperforming both professional staffing, and executive and retained search. That’s very normal at this point in the cycle, and we’re not going to see much change until the market gets more visibility into where we are in the recession cycle. But I think we’re starting to reach the bottom in these stocks, and we’ve seen some activity from some other analysts upgrading. I see very limited downside and substantial upside over the next three to five years in the stocks.”

The Data and Insights You Need to Succeed in The Near-term and Long-term

TechServe Alliance delivers the State of the Industry webinars three times a year for its member companies to provide them with the information and data they need to plan and grow. Members can view the latest State of the Industry webinar on-demand here. To better understand how to respond to both near-term market conditions and the opportunities and challenges of key long-term trends join us for 2023 Executive Summit, Nov. 14-16 at the Ritz Carlton in Amelia Island, FL. The Summit brings together owners, executives, and managers of Technology Staffing and Solutions firms to explore the strategies and tactics to succeed in today’s dynamic environment. This year’s Summit also offers unparalleled networking opportunities with industry leaders, CIOs, CTOs and executives and managers responsible for procurement of IT Services for some of the largest U.S. companies.