How Uncertainty is Impacting the Tech Staffing Industry

The IT and engineering staffing industry continues to navigate a landscape of uncertainty.

On March 20, 2025, TechServe Alliance CEO Mark Roberts and Jim Janesky, Principal Forest Advisory LLC and Investment Bank, delivered the highly anticipated Q1 State of the Industry (SOI) update. This interactive webinar provided a data-driven look at the economic, employment, and policy shifts shaping the industry. A central theme emerged from both the speakers and live poll participants: market conditions remain sluggish, with demand hindered by widespread uncertainty about the future.

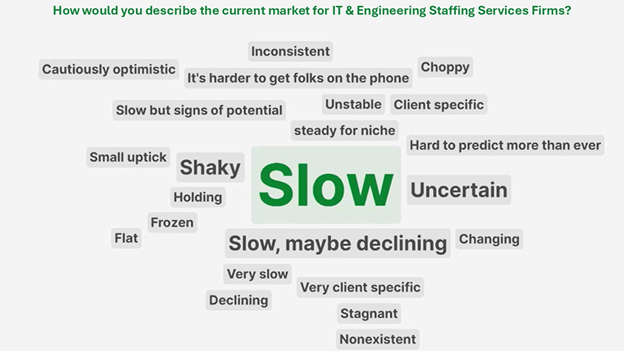

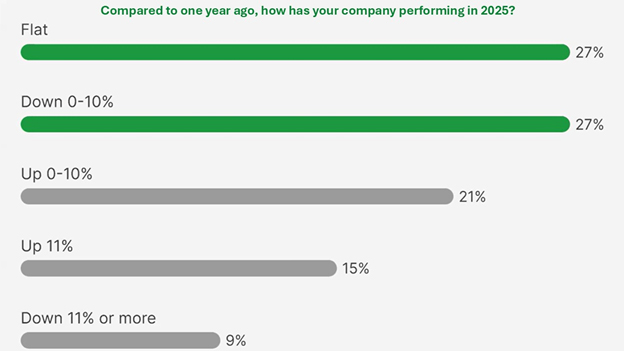

The overwhelming majority of participants in real-time polls responded that the current market for IT/engineering services was “slow” with 54% responding that the market is either down 0-10% or flat to date in 2025. Sixty-nine percent attributed the anemic demand for IT/engineering staffing and direct hires to an uncertain future.

Uncertainty Impacts Economy and Industry

So, what’s causing this chill? According to Roberts: Uncertainty.

“There have been 92 executive orders, certainly a record, to eliminate or bare-bone a number of agencies. And then the Department of Government Efficiency has resulted in a firing of employees across multiple agencies. None of this is to cast an opinion one way or another, but just to share that this is really reflecting a lot of change very fast and, consequently, resulting in uncertainty among businesses,” Roberts said.

Employment-based, high-skilled, immigration has generated an internal debate within the administration, with Elon Musk supporting H-1B visas and deputy policy advisor Stephen Miller opposing. At the same time, the new Attorney General Pam Bondi and Secretary of Homeland Security Kristi Noem have taken quick action to enforce immigration laws and initiate deportations. Roberts said, “Although [immigration enforcement has] been focused on the undocumented or lower skilled workers, we fully expect some of that to creep into the higher skilled skill sets as well. . .. USCIS will once again likely focus on fraud detection versus processing speed.”

The new Labor Secretary Lori Chavez-DeRemer has promised support for legal, employment immigration and more favorable actions for employers related to independent contractors and overtime regulations.

In the last days of the previous administration, DHS finalized the long-awaited Modernizing the H-1B Visa program regulation. The Final Rule includes many changes supported by TechServe. Roberts said, “There are some favorable developments on that front in terms of definition of specialty occupation, a Bonafide job offer, but again, they have continued to distinguish with third party placements, something for us to watch for additional issuance of policy guidance and certainly in any legislation.”

Economic and Employment Landscape: Cyclical vs. Structural Trends

Roberts gave an overview of the economic and employment landscape, looking at the data for cyclical trends and structural trends. Roberts explained that while Inflation has declined, it remains “sticky;” GDP is down from the all-time high at mid-year 2024 as Q4 came in at 2.3%, but still decent; jobs added in February were modestly below expectations but respectable. He noted that the JOLTS report shows a 1 to 1 ratio of available jobs to job seekers— down from the 2 to 1 high in the immediate aftermath of the pandemic the jobs market moves in balance.

With the overall unemployment rate holding at 4.1%, we may be seeing a structural shift to perennially tighter labor market. Roberts said that unemployment rates in IT and engineering remain low at 2.7% and 2.4%, respectively.

For many open positions, there is a lack of workers with the requisite skills. The skills gap will continue to be a challenge for the IT and engineering staffing industry. Roberts added, even though labor feels a little more plentiful, there remains secular or structural trend of lack of sufficient talent to meet the needs of businesses.

So, What Does this Mean for the Industry in 2025?

Jim Janesky provided his overview of current trends and presented the forecast for IT and engineering staffing industry.

Janesky said, “I agree . . . that uncertainty certainly is the overriding theme right now, both in the economy and within the staffing industry as a whole.” He discussed a wide range of factors impacting the industry and the economy, including the stock market, tariffs, deep government funding cuts, looming layoffs in government and in the private sector. He predicted a continued decline in GDP, largely influenced by consumer spending. Additionally, AI will not only influence labor markets but supporting data centers will significantly increase power demands increasing consumer utility costs.

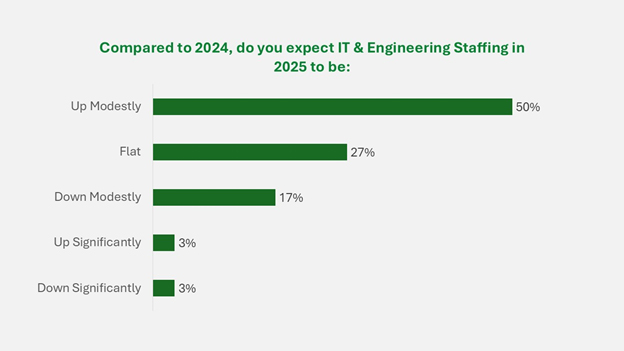

He also agreed with Roberts’ prediction regarding pockets of growth for new job orders, a leading indicator of eventual placements and IT staffing revenue, “So for 2025 we expect to start off as a choppy year” So, what is overall going on? Just like the stock market, corporate decision makers hate uncertainty and we’re unlikely to see budgets at companies increase or get released until there is more economic visibility. “I think that does revolve around tariffs more than anything right now.”

Roberts concluded, “We see some signs of improvement, projecting 1–3% growth in the IT staffing sector. Still, we expect that performance will be choppy throughout the year and uneven across firms. Clarity on policy issues and their impact on business confidence will be critical for us to see meaningful and sustained improvement.”

TechServe Alliance members can access the recent State of the Industry: A Quarterly Webinar Series here.