The dialogue around IT employment and economic indicators continues to reflect a complex landscape and narrative. Despite challenges, such as ongoing layoffs within tech companies and tepid demand for IT skills, we are now seeing emerging signs of resilience. And while the first half of 2024 is expected to be challenging for the IT and Engineering staffing industries, TechServe projects both sectors will grow 3-5% in 2024.

“We continue to see lots of mixed signals that make it challenging to weave a consistent narrative across all different data points,” said Mark Roberts, CEO of TechServe Alliance, at the most recent TechServe webinar on the State of the Industry. “Also, across firms in our industry, there’s a fair amount of inconsistency or I should say differentiation, between firms from different geographies and client portfolio exposure.”

However, corporations continue to invest in technology, and the talent that can build and manage it is imperative for business. Additionally, the unemployment rate for IT skills is at 2.42%, which is “full employment.” This will fuel demand for IT skill sets such as those associated with AI, automation, and cybersecurity.

Source: TechServe Alliance

CAUTIOUSLY OPTIMISTIC

During TechServe’s October 2023 State of the Industry update webinar, we asked technology staffing leaders about the then-current state of the market, and the recurring theme was………SLOW. At our most recent State of the Industry webinar, we again explored the nuances of the technology staffing industry and were confronted by a mix of trends, opportunities, and challenges.

The sentiment? Cautious optimism!

It certainly looks like we are moving in the right direction. The TechServe Alliance IT Employment Index marked a modest yet encouraging upturn in IT job growth in the first two months of 2024. The uptick came after 23 months of contraction or no growth, suggesting a potential rebound.

This cautious optimism is framed against a backdrop of economic and policy-related challenges, contentious immigration debates, and reliance on executive orders to bypass congressional gridlock. For instance, forthcoming executive orders on AI and visa criteria streamlining are keenly anticipated by the industry. Likewise, regulatory developments such as the Federal Trade Commission’s non-compete ban and updates on Department of Labor overtime regulations could significantly impact the technology staffing industry.

Glass Half Full or Half Empty?

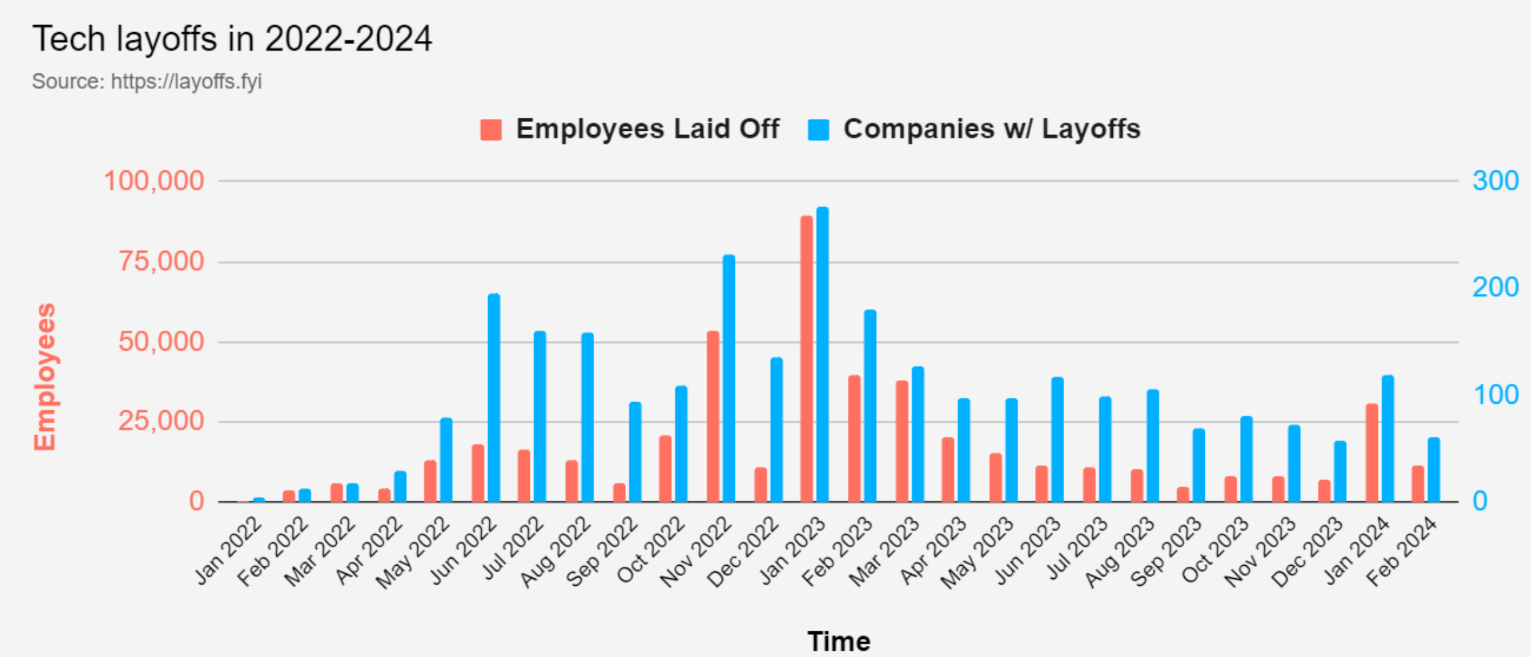

While the tech layoffs have made recovery for the tech staffing industry an uphill battle, the good news is that they peaked at the beginning of 2023 and have trended down since then, according to Layoffs.fyi.

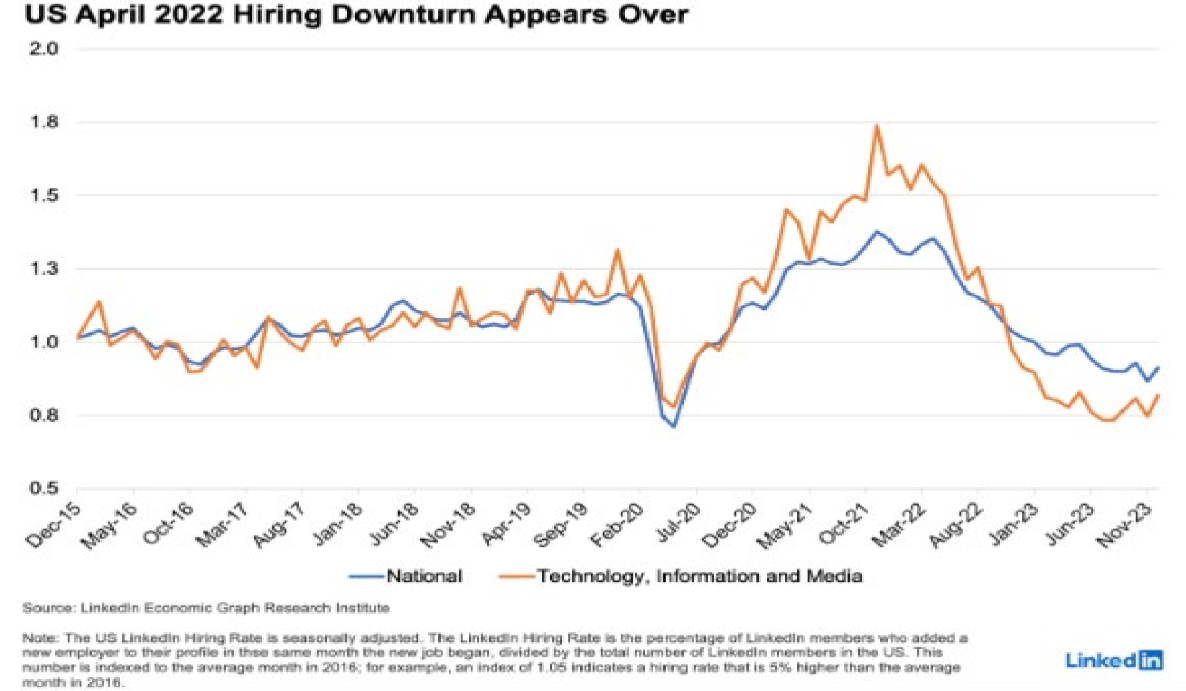

Similarly, hiring data from LinkedIn shows that hiring for technology and media roles plunged toward the end of 2022 and 2023, but has stabilized now.

These data points and the employment growth we are beginning to see in the TechServe Employment Index, reflect that while we are not out of the woods yet, there’s an underlying belief in the tech staffing sector’s potential recovery.

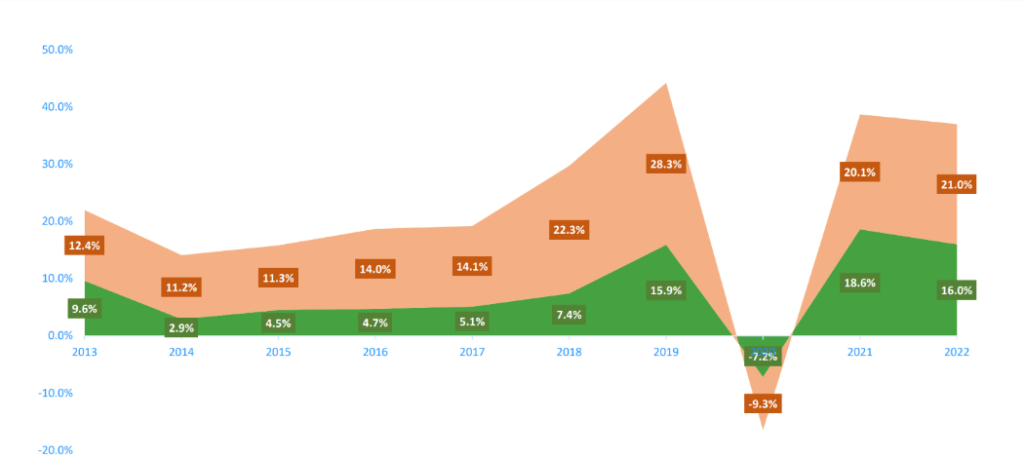

Level Setting: 2021 & 2022 Were Challenging Baseline

Level setting against the highs of 2021 and 2022 reveals the challenges inherent in sustaining the growth experienced by IT staffing firms at that time. According to TechServe’s 2023 Operating Practices Report (OPR), IT staffing firms experienced record high growth of 18.6% and 16% in 2021 and 2022, respectively, setting a very high baseline.

Source: TechServe Alliance

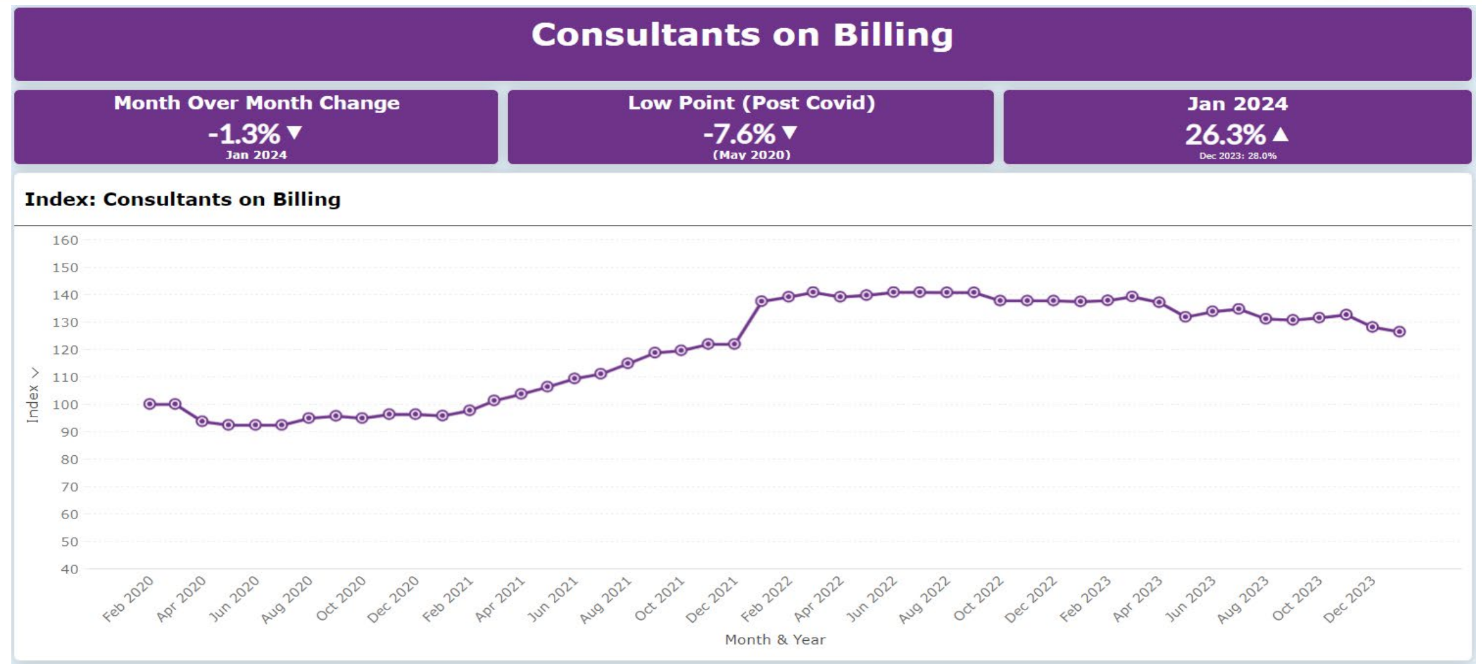

In addition to the annual Operating Practices Report, TechServe has a Monthly IT & Engineering Staffing Dashboard to help technology staffing firms track KPIs and benchmark them against the industry. The ebb and flow of growth can be seen for Consultants on Billing which at the low point was down 7.6% in May 2020. It declined 1.3% in month over month change in January 2024 and was up 26% in January of 2024 compared to February of 2020.

Source: TechServe Alliance

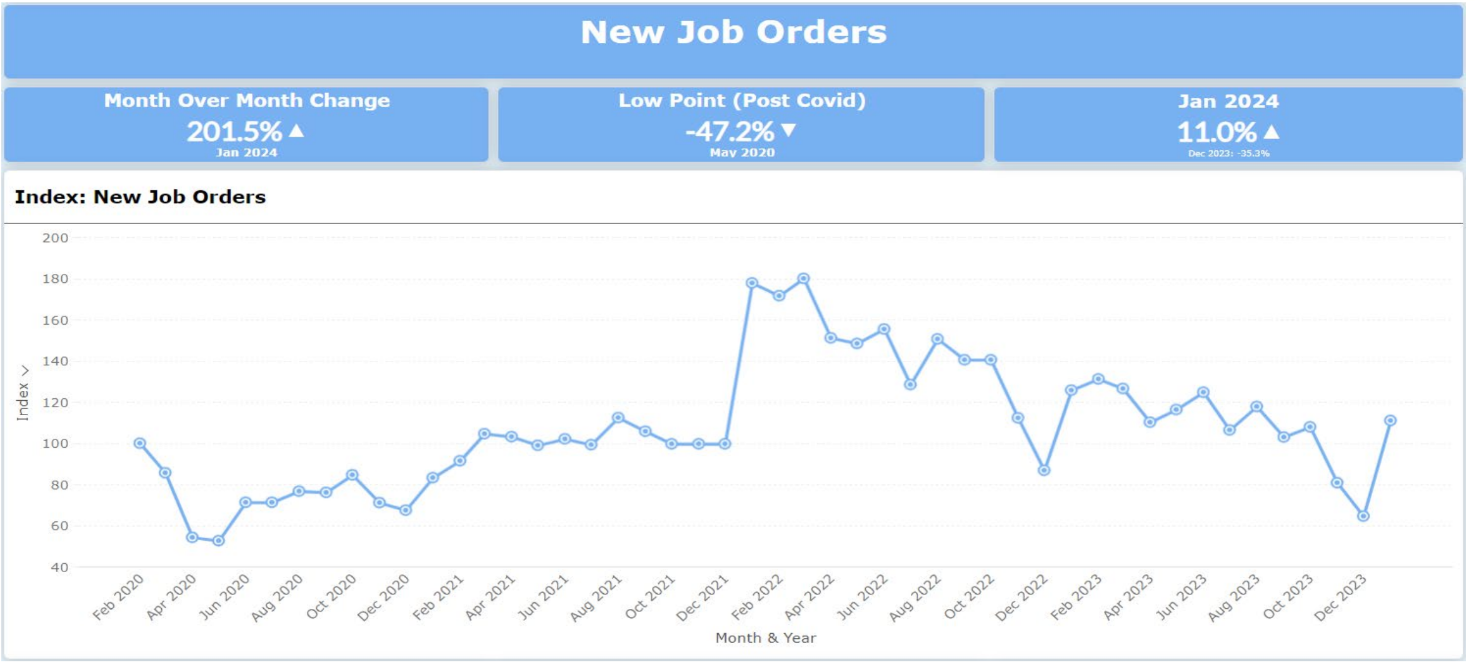

Another important KPI to track is New Job Orders and the data points for which from February 2020 to present look like an EKG chart.

Source: TechServe Alliance

“The good news is January was much more encouraging than the prior two months where job orders were down significantly towards the end of 2023, but up 11% in January over the February 2020 benchmark,” Roberts said. “Obviously, I don’t encourage you to rely on just one monthly change, but you can see the general trajectory”

KEY LONG-TERM TRENDS IMPACTING THE INDUSTRY

- The future of remote and hybrid work

Data from LinkedIn shows that in December 2023, only 8.9% of all job postings offered remote work versus 20.3% in April 2022. In comparison, 45.9% of job applications from candidates received in December 2023 were for positions with remote work. This is both an opportunity and a challenge — It’s a challenge for IT staffing firms to find candidates willing to work with clients who want their employees/consultants to work onsite, but it could be an opportunity for those that are willing to hire remotely as it expands the talent pool. - Artificial Intelligence (AI)

No doubt, AI represents both an opportunity and a threat. It’s an opportunity in terms of filling those hard-to-find jobs but it’s perceived as a threat both in terms of displacing many current skill sets that are placed by technology staffing firms as well as companies’ view that they could utilize AI to disintermediate staffing firms.

“Obviously that view has been held before with other technological innovations such as the job boards, the aggregators and the like but it has not come to pass,” Roberts said. “This is certainly something that we’re going to be very focused on in terms of analyzing the potential impact of AI on our industry.” - The Scarcity of IT Talent

If we separate the cyclical declines, which are really tied to decline in GDP and the economy, the overall challenge for the tech staffing sector is the talent supply. “It’s a long-term challenge for our sector and while there’s not a lot you can do about the overall economic backdrop, but being a strong recruiter of talent is something that is going to be in demand as we come out of the economic dip.”

Economic Trends

According to Jim Janesky, Principal, Forest Hill Advisory and a speaker at the TechServe webinar, the broader economic outlook introduces additional layers of complexity. Anticipated mild recessions, linked to fluctuations in GDP and IT staffing market growth rates, underline the sector’s sensitivity to economic cycles. Despite these concerns, the demographic composition of the labor market and secular trends suggest tenacity, potentially cushioning the impact of economic slowdowns on jobless claims.

The nuances of consumer behavior, government spending, and debt levels present a mixed picture. While IT spending declined in 2023, optimism for future investments, particularly in emerging areas like AI, persists. The engineering sector faces its set of challenges but also spots opportunities in infrastructure and manufacturing, notwithstanding supply chain disruptions.

As we survey the landscape of the IT and engineering staffing industry, we find it stands at a crossroads, facing an array of economic and policy challenges yet buoyed by a resilient labor market and potential areas of growth. As we look towards 2024, the atmosphere is marked by cautious optimism, underpinned by a belief in the sector’s ability to navigate the complexities of an evolving economic and regulatory environment. This sentiment, cautiously optimistic, encapsulates the industry’s hope and adaptability, looking forward to the spring thaw that lies ahead.

The fluctuating economic landscape presents a persistent challenge for the IT and engineering staffing sector, with broader economic conditions largely beyond our individual influence. Yet, within these uncertainties, the value of skilled talent recruitment remains constant. Excelling in talent acquisition not only serves as a stabilizing force during downturns but also plays a critical role in driving recovery and growth as the economy recovers. This continual need for adept recruiters accentuates the strategic importance of developing strong recruitment capabilities, enabling organizations to navigate through economic shifts with agility.

TechServe Alliance members can watch the whole State of the Industry: February 2024 webinar here.