Poor hiring practices are nothing new. Nor is the aggravation experienced by recruiters who have to work with – and around – them. Recruiters can tell endless tales of:

- ✔Hiring managers who take too long to decide whether to interview candidates or not;

- ✔Interview processes that are overly long, cumbersome, and poorly planned;

- ✔Offers that aren’t competitive. The list goes on and on.

One would think that would change, given today’s tight talent market. Almost inexplicably, they’re getting worse. Rick Carlson, director of the Sales and Recruiting Management Program at TechServe Alliance, as well as the Founder and President of Harvyst Consulting Partners, says it all started with the pandemic.

“COVID was the earthquake,” Carlson says. “The aftershock is the Great Resignation.” The Great Resignation has shown that people like to work from home and can be just as productive there. They don’t want to commute; they want more time for themselves. They can start their own businesses. And many are finding that they’re worth more than they’re being paid. Amid these facts, however, Carlson notes two competing dynamics.

“Candidates are in control. But clients struggle to accept this; they want to stick to the way it’s always been done,” Carlson adds.

Opportunity in Crisis

In a recent TechServe webinar, Carlson urged staffing organizations to see the shakeup in the technology staffing sector as an opportunity to help clients improve their hiring practices – perhaps once and for all. To help them see that speed, along with quality, is everything

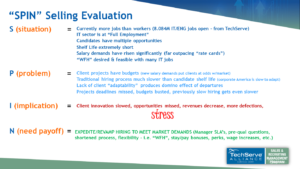

These aren’t easy conversations to have with clients; they’re pointed and honest. But with good questioning techniques, and data-driven insights, these tough conversations can be game-changers. In walking through the structure for a constructive discussion, Carlson looks at the four elements of the SPIN selling model:

| S | Situation: Know the context |

|---|---|

| P | Problem: Understand the pain points |

| I | Implication: Impact of the problem |

| N | Need Payoff: Solution to the problem |

The Situation

Professionals in the staffing sector know that the situation is challenging. Do all of your clients understand this, though? There’s plenty of evidence to support the case for change. A few recent statistics that Carlson shares with clients to underscore the current reality of the market:

- »With 8.1 million open jobs, there are more IT jobs than workers. The IT sector is at full employment, making passive recruiting the order of the day…and difficult.

- »62% of workers have asked for a raise post-COVID, and 23% have asked for more perks.

- »The ‘shelf life’ of candidates is extremely short; 60% of people who took new jobs had at least two other competitive offers.

- »30% of workers are actively seeking new employment. For Gen Z, that number rises to 54%.

- »25 million people quit their jobs in January; another 4.35 million did the same in February and it jumped to 4.5 million in March.

The Problem

Carlson asks three key questions to help clients define the problem.

- Have you felt any impact from the Great Resignation?

- Have you lost anyone you weren’t expecting to lose?

- Is there anyone on the team that would cause a significant impact if they left?

Smart follow up questions can help further clarify the scope of the problem, such as:

- »How many open positions do you have?

- »Do you measure time to fill?

- »Do you measure response time by managers?

- »Do you know your hiring failure rate (people who quit or are terminated before project completion)?

- »Do you measure the cost – in lost revenue – for each day a job goes unfilled?

- »Do you measure the number of offers extended but rejected (offers that were declined, or where the candidate is no longer available)?

The Implication

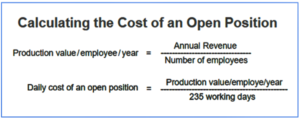

One data-driven way to show clients the business impact of poor hiring processes is to help them calculate the financial cost of an open position. To do so, Carlson recommends a simple formula.

The company’s annual revenue divided by the number of employees results in the ‘production value’ of each employee per year. Divide that by the 235 working days in the average employee’s year, and you get the daily cost of an open position. As you can see, one position left unfilled for 30 days can easily reach tens of thousands of dollars. These costs add up in project delays, missed deadlines, canceled contracts, and more.

That’s only the direct financial impact, though. The indirect effects of poor hiring processes can be much further-reaching. As Carlson points out, there’s a ‘domino effect’ resulting from unfilled positions that some companies don’t take into account. When a key member of a project team leaves, their responsibilities don’t leave with them; others have to pick up the slack. This leads to increased stress and pressure on those left behind, who in turn start looking for other jobs. With each person who quits, those remaining are at greater risk of doing the same.

The Need-Payoff

The solution is clear: in this climate, clients must revamp and expedite their entire hiring process. Carlson isn’t alone in seeing this as the answer. He points to David Brooks, SVP and CTO with Cox Automotive, recently named Large Enterprise CIO of the Year. Brooks said, “We have doubled down on the experience candidates have as part of our interview process.” They’ve done so by focusing on making great first impressions, shortening the interview process, and highlighting their current tech talent. According to Brooks, “IT leaders should focus on selling their company as much as the candidates are selling their skills.”

SPIN Model Applied to Technology Staffing

The Missing Link: Hiring Manager SLAs

According to Carlson, there’s an underlying reason why – despite market conditions – hiring processes aren’t improving. Everyone in the hiring process – Human Resources, staffing vendors, candidates, and the onboarding team – has Service Level Agreements or SLAs. There’s one conspicuous exception: the hiring manager.

“The ultimate contributor to hiring is virtually unchecked. There’s no performance scorecard.” In many cases, Carlson says, there’s no measurement of the cost of time, and the cost of failed hires, that some hiring managers create. In exploring a company’s problem areas – elapsed time in the hiring process, candidates lost, poor hires, and the domino effect of unfilled positions – Carlson believes that clients can see the value of assigning SLAs to hiring managers.

As with any SLA, the metrics must be meaningful to be effective. Carlson suggests:

- »Days to respond to candidate submissions

- »Days elapsed between the agreement to interview, and the interview itself

- »Days between the first and final interview

- »Candidates that interview per job (too many may indicate poorly-crafted job orders)

- »Days elapsed between the final interview and offer presentation

- »Number of offers accepted vs. rejected

- »Days from acceptance to start

- »Number of rehires (indicating the failure rate of the hiring process overall)

In Summary

The IT talent market is tighter than ever, with market conditions that overwhelmingly favor the candidate. The shelf life of candidates is extraordinarily short, with most candidates having multiple offers in hand. Flexibility is key, with hybrid and remote work arrangements, higher compensation, stay bonuses, and other benefits increasingly required to hire and retain top talent.

Above all else, broken hiring processes need to be fixed, and to do this, tough conversations have to happen at all levels: HR, management, and executive. Change won’t come in one meeting. We have to be persistent in our efforts and back the conversations with what the client will gain by changing. This represents a unique opportunity to radically improve client hiring practices. To learn more, you can view the webinar recording here.