Consultants on Billing Down 8.3%: New Job Orders Down 30% From Pre-Pandemic Levels

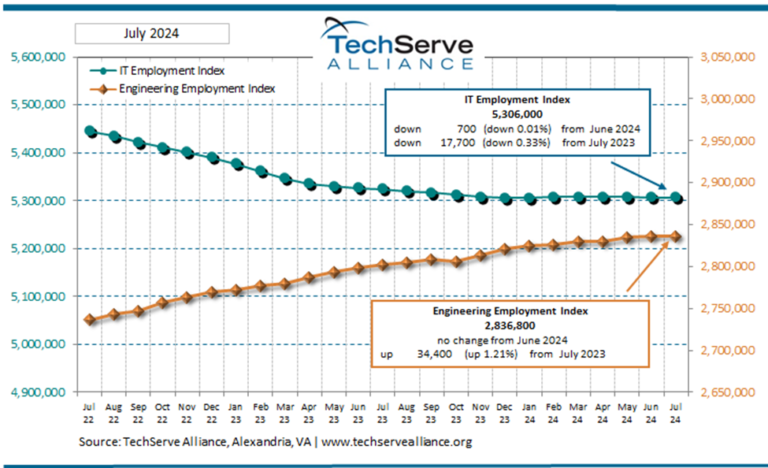

TechServe Alliance announced the most recent data from its IT & Engineering Staffing Dashboard™, sponsored by CEIPAL. IT & engineering headcount stabilized in June and July (flat and up 0.5%, respectively) after dropping March through May. While improved from its low point in April, New Job Orders are down 29.6% from Pre-Pandemic levels foreshadowing ongoing headwinds in the coming months.

On a positive note, clients have been holding on to consultants with the stop rate declining to 5.2% — below levels seen before the onset of COVID-19. With fewer requisitions to fill and available recruiter capacity, fill rates have increased since April and stand above pre-COVID levels rising to 17.3%. While Direct Hire dropped precipitously consistent with the pattern of past downturns, it has shown surprising growth in June and July.

“After a brutal Spring, it appears that KPIs for the industry have stabilized through June and July. While the impact of economic fallout from COVID-19 is very uneven among firms and highly dependent on client mix, the industry is fortunate to be more resilient than other sectors” observed Mark Roberts, CEO of TechServe Alliance. “With that said, we are not entirely out of the woods. While job orders, a leading indicators of future placement activity, have recovered from their April nadir, we are still almost 30% below pre-pandemic levels,” added Roberts.