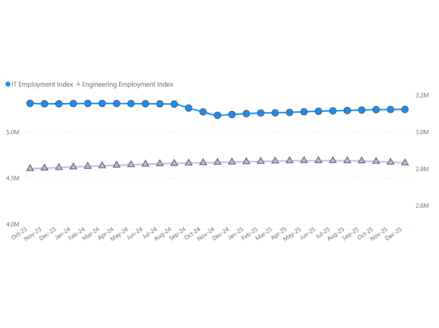

With demand for IT and engineering staffing services remaining sluggish and uneven amid continued economic uncertainty, a focus on business optimization including enhanced efficiency and cost control were the keys to achieving above average profitability, according to the 2025 TechServe Alliance Operating Practices Report (OPR), the industry’s foremost benchmarking analysis.

A few key highlights from the report include:

- Profitability was Under Pressure for All Firms: In an environment characterized by anemic client demand and eroding gross margins, profitability was under pressure for firms in all categories. After hitting a high 6.3% of revenue in 2021, bottom-line profitability declined for the median firm to only 2.5%. The deterioration was evident even among the most profitable companies with the median firm in the top quartile dropping from above 11% in 2020 through 2022, to only 5.2%—the lowest in at least a decade.

- Firms With More Direct Hire Business Fared Better, While Those with Focus on VMS/MSPs Struggled: Where direct hire was a larger percentage of a firm’s overall revenue it was generally more profitable. Firms with over 50% of their revenue attributable to VMS/MSPs struggled— barely profitable at 1.4%.

- Operational Effectiveness was One of the Only Levers Available: Given these challenging conditions, higher levels of profitability was almost exclusively attributable to operational efficiency and effectiveness reflected as lower SG&A costs as a percentage of revenue.

- Managing Every Expense Line Matters: Higher profitability was not the result of cutting one major cost, but rather the cumulative impact of reducing expenses across many categories. For example, compared to the high-profit firm, the typical firm spent three times more on LinkedIn, two and a half times more on business insurance, twice as much on their internal IT, and 50% more on accounting.

“While revenues stabilized in 2024 after declining to a median of 8.3% in 2023, margins and bottom-line profitability remain under extreme pressure for almost all firms. Across the board, profitability was down markedly for most IT & Engineering staffing firms,” commented Mark Roberts, CEO of TechServe Alliance.

“As we have seen in prior periods where client demand is anemic, lower SG&A expenses as a percentage of revenue was the primary determinant of whether a firm achieved ‘High Profit’ status. While larger firms have an advantage on this front as they can spread their back office and other internal costs over more revenue—benefiting from the economies of scale, astutely managing each expense line is also critical” observed Roberts.

As the only annual benchmarking analysis exclusively focused on the IT & engineering staffing industry, this comprehensive benchmarking report covers a wide range of metrics including data points on operating in the remote and hybrid work models.

- Revenue

- Gross Margin & Profitability

- Impact of Direct Client Relationship, VMS/MSP with Hiring Manager Contact, and VMS/MSP Without Hiring Manager Contact on Close Rates, Margins and Profitability

- SG&A Expenses—what areas of expense control help drive higher profitability

- Compensation and Metrics for Sales & Recruiters at Different Levels of Experience

- Benefits for Internal Staff, Hourly and Salaried Consultants

- Industry Trends

- And much more!

Learn more about the 2025 Operating Practices Report here. A Sales & Recruiter Metrics Report will be released in the future.

About TechServe Alliance

TechServe Alliance is the national trade association of the IT & Engineering staffing and solutions industry. IT & Engineering staffing and solutions firms and affiliated professionals count on TechServe Alliance to keep their leadership informed, engaged, and connected. By tapping the “collective scale” of its companies, TechServe provides access to industry best practices and insights as well as innovative products and services supporting its stakeholders in the efficient delivery of best-in-class IT & Engineering staffing and solutions for clients and exceptional professional opportunities for every consultant.