“Revenue cures a lot of ills, but just be sure it’s profitable revenue.”

Rick Carlson, director of TechServe’s Sales & Recruiting Management Program

Profitability is the cornerstone of any business, and it’s no different for IT and engineering staffing firms. Staying ahead of the curve is essential in a constantly changing and evolving market. The question is, how can you not only survive but, more importantly, thrive in this competitive landscape?

The answer is simple but not easy: you need to manage profit and loss (P&L) effectively. High-profit firms have mastered the art of balancing important financial metrics, streamlining operations, and managing costs to achieve maximum profitability.

So, what sets these firms apart from others? Staffing industry expert Rick Carlson, director of TechServe’s Sales & Recruiting Management Program, shares some valuable insights on managing profit and loss to stay ahead of the competition.

The Financial Foundation of High-Profit Firms

As a staffing firm, you need to understand essential financial metrics. This is the first important step you can take toward maximizing profitability. Important indicators of financial health are:

- Gross profit

- SG&A (Selling, General, and Administrative expenses)

- EBITDA

Carlson emphasizes that you need to keep a close eye on these metrics so you can see whether or not revenue is effectively converted into profit. He explains, “Out of every dollar, 17.5 cents becomes profit for typical firms compared to high-profit firms doing almost 30 cents on every dollar.”

According to Carlson, the three most important numbers you should always know in your business:

- What is your total gross margin as a percent of revenue?

- What are your total expenses as a percentage of revenue?

- total gross margin minus expenses = profit and we should know what that is as a percentage of our overall revenue.

High-profit firms also excel at managing their return on assets (ROA). How? They focus on key profit variables like:

- Personnel Productivity Ratio

- Gross Margin Percentage

- Operating Expense Percentage (SG&A)

- Average Collection Period (Days Sales Outstanding DSO)

This can significantly increase their profitability. Carlson also mentions that high-profit firms maintain a lower DSO. This means they collect payments faster and can maintain healthier cash flows.

How to Manage Payroll and Operating Expenses

One of the standout qualities of high-profit firms is their ability to manage payroll expenses efficiently. High-profit firms spend 51% of their gross profit on payroll, while typical firms spend 57%.

Carlson stresses the importance of balancing payroll and operational costs. Yes, cutting expenses can boost profit – but it needs to be done strategically. This is because, of course, you want to avoid impacting the firm’s operations negatively.

“Any reduction in expenses goes straight to profit, but slashing costs too much can be dangerous,” Carlson warns.

And, how high are SG&A expenses of more and less successful firms on average?

- High-profit firms: 18.8% of revenue

- Typical firms: 22.6% of revenue

Revenue Sources and Gross Profit Margins

When it comes to revenue sources, the majority of income for staffing firms comes from direct contact IT and engineering placements.

Interestingly, high-profit firms recently saw a substantial increase in Managed Service Providers (MSP) placements. They jumped from 26% in 2021 to 48% in 2023.

This shift towards lower-margin, shorter-term deals has affected overall profitability, but high-profit firms continue to overcome these challenges by focusing on efficient operations and keeping costs in check.

While MSP business provides significant revenue, it also contributes to a drop in gross profit margins. Why? It often involves lower-margin work.

Effective Compensation and Productivity

A big differentiator for high-profit firms is their approach to compensation. The Effective Compensation Rate (ECR) measures how much of a firm’s gross profit is consumed by compensation expenses.

And yes, as you might expect, there is a difference between the ECR that high-profit firms and typical firms maintain:

- High-profit firms: 33.3%

- Typical firms: 38.6%

Carlson advises firms to keep the ECR between 25-40% to avoid payroll expenses from excessively eating into profits.

Additionally, the GP-to-Producer ratio is essential for deciding when to hire new staff. Carlson recommends focusing on improving the productivity of existing employees if gross profit per producer falls below $18,000 per month.

“It’s critical to know when to add staff and when to push existing employees to achieve higher productivity,” Carlson adds.

Is Remote Work Staffing Bad for Your Profit and Loss Strategy?

Did you know that by the end of 2023, 73% of billable consultants were working hybrid or remotely? This number is up from 50% in 2020.

This shift led to a notable trend this year: both time to fill and failure rates are on the rise. Remote work contributed to higher job failure rates and lower job fill ratios, especially for firms with a higher mix of MSP business.

The job fill ratio was 1 in 5 for high profit firms , compared to 1 in 3 for typical firms. This can be attributed to typical firms don’t have a big mix of MSP and are dealing more directly with hiring managers.

Improve Profit Margins

If your staffing firm wants to increase profitability, you can start by regularly evaluating SG&A expenses. Identify areas where costs can be cut without affecting performance. This is the main takeaway that Carlson recommends incorporating.

It is also a good idea to keep a close eye on payroll expenses to ensure that compensation plans are aligned with the firm’s profitability goals.

To sum up Carlson’s tips for managing profitability for your IT and engineering staffing business

- Know your numbers: GP%, SG&A%, EBITDA

- Know what percent of your GP drops to profit (target 33%+)

- Manage SG&A… but mostly “S” (target 15-20%)

- Manage PPR/Effective Compensation Rate (ECR)

- Calculate Employee Profitability

- MBO’s to offset higher salary requests

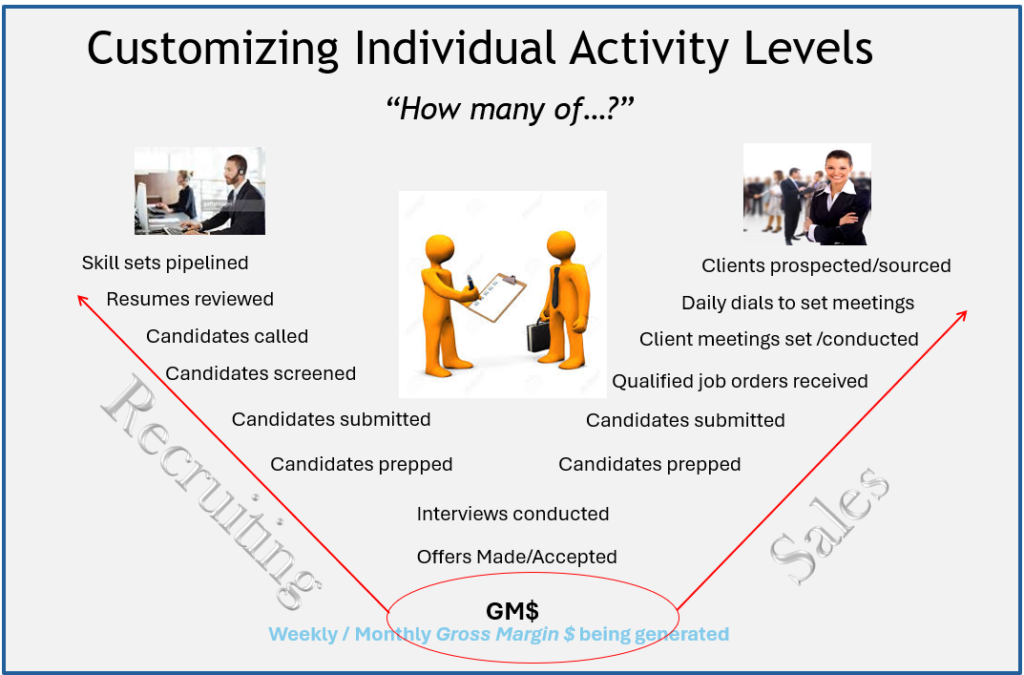

- Track Weekly Performance & build custom activities based on individual or team performance

- Know TTF and failure rates (no shows, fail to complete)

- Review GP to Producer ($18K – $28K room to improve)

- Let your P&L guide “When to Hire”

Carlson says it best: “Revenue cures a lot of ills, but just be sure it’s profitable revenue.”

You can view the full webinar here.

Hear further insights from Rick Carlson at the 2024 TechServe Executive Summit.