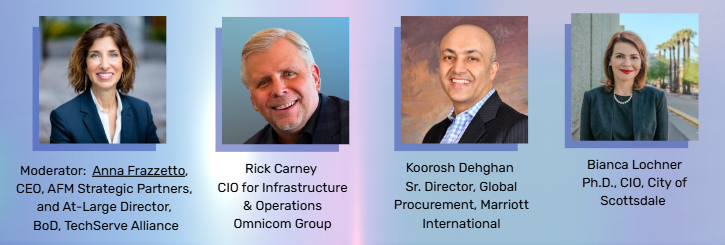

At the 2025 TechServe Executive Summit, three senior decision-makers opened up about what truly influences their selection of IT staffing partners—what earns trust, what kills momentum, and what differentiators actually matter. The panel, moderated by Anna Frazzetto, CEO of AFM Strategic Partners and At-Large Director on the TechServe Alliance Board of Directors, drew insights from Koorosh Dehghan, Sr. Director of Global Procurement at Marriott International; Rick Carney, CIO for Infrastructure & Operations at Omnicom Group; and Bianca Lochner, Ph.D., CIO for the City of Scottsdale.

Their remarks painted a clear, unscripted picture of how buyers evaluate vendors in a world where 30 to 40 firms might be competing for the same role.

Preparation and Listening Are Still the Fastest Ways to Stand Out

All three panelists stressed that vendors win when they come in informed and engaged—not with a one-size-fits-all pitch.

Dehghan made it plain from the start:

“If they come with a generic deck, that’s a goodbye right there.”

He explained that when a vendor arrives already understanding Marriott’s structure and needs—and asks questions before pitching—“that impresses me.”

Lochner echoed the importance of arriving prepared, especially when the information is readily available. Scottsdale publicly posts its mission, priorities, long-term goals, and budgeting outlook. She said she immediately takes notice when a prospective partner walks in already aligned with those materials:

“When potential partners come engaged, understanding our mission and our priorities… then we can talk about specific problems we can solve together.”

Frazzetto tied their points together during the discussion, noting that buyers can instantly distinguish between vendors who listen and vendors who “show up and throw up.”

Buyers Tune Out Industry Assumptions and Buzzwords

Carney has seen plenty of pitches—and plenty of noise. He explained that vendors often lead with statements that fall flat:

“Noise to me are vague statements or ROI promises that really are not ROI.”

He also warned against assuming that experience with a similar company is automatically a differentiator:

“Noise to me are companies that have done some type of business with a company in the same industry and they think they immediately know everything about my company.”

Dehghan shared the same frustration, particularly around tech clichés.

When a vendor says “we’re using AI,” he immediately asks, “What does that mean? How are you using it? How’s that going to help me?”

The message was clear: overused jargon without specifics is more damaging than helpful.

The First 90 Days Reveal Whether the Partnership Will Work

Lochner gave one of the most striking examples of the session—an ERP implementation that went sideways within the first three months.

“We realized there’s no way—they don’t have the expertise to move us forward,” she said. Change orders began piling up early, and cultural alignment was missing. Looking back, she said, “We know exactly what failure looks like.”

Carney agreed that the first 90 days tell the story.

“No change orders in the first ninety days is a good thing,” he said. He also warned against bait-and-switch resource assignments: if the team that sold the work isn’t the team that shows up later, it often derails the engagement.

Dehghan added that Marriott tries to protect against that by naming team members directly in contracts and setting limits on how many can be swapped out. If replacements are required due to the vendor’s delays, he expects them to arrive fully prepared:

“We would ask the vendor to upscale and bring the resource up to date at their own expense.”

Transparency in Pricing Makes or Breaks Trust

All three panelists emphasized that unclear or shifting pricing becomes a major credibility problem.

Lochner said Scottsdale evaluates solutions through the lens of total cost of ownership. That includes implementation, renewal, and operating costs—especially because the city must maintain the trust of its residents.

Hidden expenses or unexplained change orders quickly erode that trust:

“Implementation costs… sometimes those are not clear upfront, and that erodes trust.”

Dehghan shared that clarity matters more than the price itself.

“If there are additional costs, I want to understand what’s driving that,” he said. Sudden or unexplained fees “kind of lose my trust.”

Carney added a practical complication: sometimes the onboarding journey with a new vendor takes too long.

“If it’s a new company and we’ve got to go through that onboarding process… it could be sixty days before we’re actually working with them.”

What Proof Points Actually Matter

When evaluating a new partner, all three decision-makers put more weight on outcomes than promises.

Lochner explained that Scottsdale prefers short, focused POCs backed by measurable results:

“We want a baseline when we start a POC, and then we measure the progress we’re making toward a certain outcome.”

Carney relies heavily on try-and-buy periods for staffing and proof-of-value pilots for products.

For a full-time hire, he emphasized the benefit of starting with a 90-day contractor period:

“Then we can make that decision without putting the burden of probation and performance review on us internally.”

Dehghan said one of his biggest proof points is simple but non-negotiable:

“Clarity in pricing. No hidden fees.”

Communication and Presence Carry Real Weight

Strong communication was another major theme.

Carney said that if a vendor’s team is truly part of the effort, they should be embedded in the process:

“They’re on the teams, they’re in the status calls.”

Dehghan encouraged vendors to put in personal effort—especially when sharing updates or results.

“Put together those executive reports, and if you can, deliver it in person… we’ll remember you.”

Lochner added that long-term success comes from shared accountability:

“We co-own the outcome.”

AI Raises the Stakes Around Governance and Compliance

When it came to AI-enabled tools, the panelists described rigorous and evolving processes.

Lochner shared that Scottsdale uses a 60-question AI governance survey that covers security, privacy, data handling, and risk.

Carney described Omnicom’s review, which requires identifying the tool, explaining the business justification, and undergoing a vendor risk assessment.

Dehghan noted that Marriott’s policies continue to evolve alongside the technology, and vendors should do their best to align:

“Try to understand what our policies are… if you can use our tools, that’s best.”

What Buyers Reward—and What Ends a Meeting Early

The closing rapid-fire round delivered some of the session’s most memorable insights.

Lochner rewards vendors who help solve real problems.

Carney penalizes something surprisingly simple but revealing:

“Typos.”

Dehghan said he loses trust when vendors overpromise and underdeliver—but he becomes a strong advocate when they keep their commitments.

Asked what keeps him in the room longer, Dehghan summed it up perfectly:

“If the deck they’re using is specific to our company and it’s not a generic deck… that shows they put in the work.”